Foundr Magazine publishes in-depth interviews with the world’s greatest entrepreneurs. Our articles highlight key takeaways from each month’s issue. We talked with Chris Savage and Brendan Schwartz about buying back their business, Wistia, from investors. To read more, download this issue of the magazine for free.

—————

“You shouldn’t be profitable.”

That was the feedback Chris Savage and Brendan Schwartz received a few years into building their video marketing business, Wistia.

“And the first time you hear it, you brush it off. But everyone we talked to [said] the same advice over and over and over,” Savage says.

At that point, the business had $10 million in revenue, which was extraordinary for the two college friends turned founders. However, more experienced founders kept pressuring them to reinvest and grow.

“We eventually decided that we were wrong and we shouldn’t be that profitable. I think impostor syndrome and all these things affected us,” Savage says. “And so we decided to push really hard to grow.”

So they green-lit as many new projects as possible and scaled their hiring from four employees to 50. The growth surged the business forward. But for all the external recognition they received for “growing,” internally, they knew something was wrong.

In 2017, Savage and Schwartz decided to take back their business.

They bought out their investors, and now the business is completely back in the hands of the co-founders. And they’ve built Wistia into a leading B2B video marketing platform that helps teams create, host, and measure the impact of their videos.

Growth at All Costs

In 2017, the co-founders’ commitment to scale attracted offers from three separate businesses within the same month. But the growth came at a cost.

“What ended up happening was we lost $50,000 one month, and the next month, revenue went up but not as much as we were expecting. So we lost a hundred thousand, and then the next month, the exact same thing happened,” Savage says. “Suddenly, your losses start to add up, and what ends up happening is everyone gets short-term focused.”

“Suddenly, your losses start to add up, and what ends up happening is everyone gets short-term focused.”

Because Wistia’s strategy had been growth at all costs, the company could not control its spending rate, and the cash from their profitable years dwindled.

“That changes your psyche. It changes how you make decisions,” Savage says. “We never said, ‘Hey, be short-term focused.’ That never once happened. But naturally, by being in that state, everyone started asking those questions, and it changed the projects we could do.”

At one point, the two emailed the entire company and asked team members to add their ideas for increasing revenue in the next 15 to 30 days to a Google Sheet.

“It was the polar opposite of the business we had built and what we stood for,” Savage says. “In that moment, we actually weren’t telling each other how unhappy we were.”

One evening that summer, the two friends sat next to each other on the edge of the loading dock in the back of their building. They contemplated what selling Wistia would mean.

If they sold the business, they’d probably stay on for two years.

After that, what would be next?

They still loved working together, so they’d probably start another business.

In what space?

They thought video still had plenty of opportunities.

Who would they hire?

Probably the people sitting in the office behind them.

“And we were like, ‘Wait, what? We’re just going to rebuild Wistia if we sell the company. Why do we need to rebuild it?’” Savage says.

“We’re just going to rebuild Wistia if we sell the company. Why do we need to rebuild it?”

Wistia had started in Schwartz’s living room in Cambridge, Massachusetts, and now they had two offices of team members and multiple investors salivating at the potential of an exit.

Getting out made sense. Letting go was the practical decision.

But the co-founders decided instead of selling the business they built together, they’d fix it.

The Shift

It took $17.3 million to buy out their investors and liquidate the stock for their tenured team members. But for the first time in years, the business got focused.

“It was a very freeing and expansive feeling. It felt like we were in control again,” Schwartz says.

“It was a very freeing and expansive feeling. It felt like we were in control again.”

One of the ways they reclaimed control was by letting their employees be part of the Wistia reboot.

“So even before we knew we were going to raise debt, we said, ‘We’re just going to be open and transparent about this and that we have these offers to sell the business. We declined them for this reason. This is what we want to do.’” Schwartz says. “It created a ton of turbulence, as you can imagine.”

The shift was dramatic. Many people took their stock options and left. But the uncertainty also spurred curiosity.

Suddenly, the remaining employees were paying more attention to meetings during financial reports. They started asking about spending within the business—everything from breakroom snacks to office space costs.

“If you’ve got people focused and motivated on how the business is running, you just got a lot more efficient and lean,” Schwartz says. “When you’re growing quickly, you just don’t care about that, and it doesn’t matter. But if you’re trying to run a tight ship, that matters more.”

Savage says the risk of not selling paid off for the culture and financials of the business.

“We all underestimate focus and alignment,” Savage says. “But it turns out often if you get everyone focused on three [problems] instead [of 10], you make a lot more progress.”

“We all underestimate focus and alignment.”

In 2017, the business was on track for a negative $3 million in EBITDA (earnings before interest, taxes, depreciation, and amortization).

In 2018, they were positive $6.3 million in EBITDA—a $9 million swing in fewer than 12 months. They quickly set up a profit-sharing program, which motivated their team even more.

“We took a lot of the risks that only we felt like we could take. And it worked. We got really long-term focused, and it caused revenue to accelerate a huge swing in profitability. And recently, we just paid off that debt. It’s been a pretty amazing thing to realize and to do,” Savage says.

Thanks to this transformation, Savage and Schwartz regained the confidence to invest in projects they cared about.

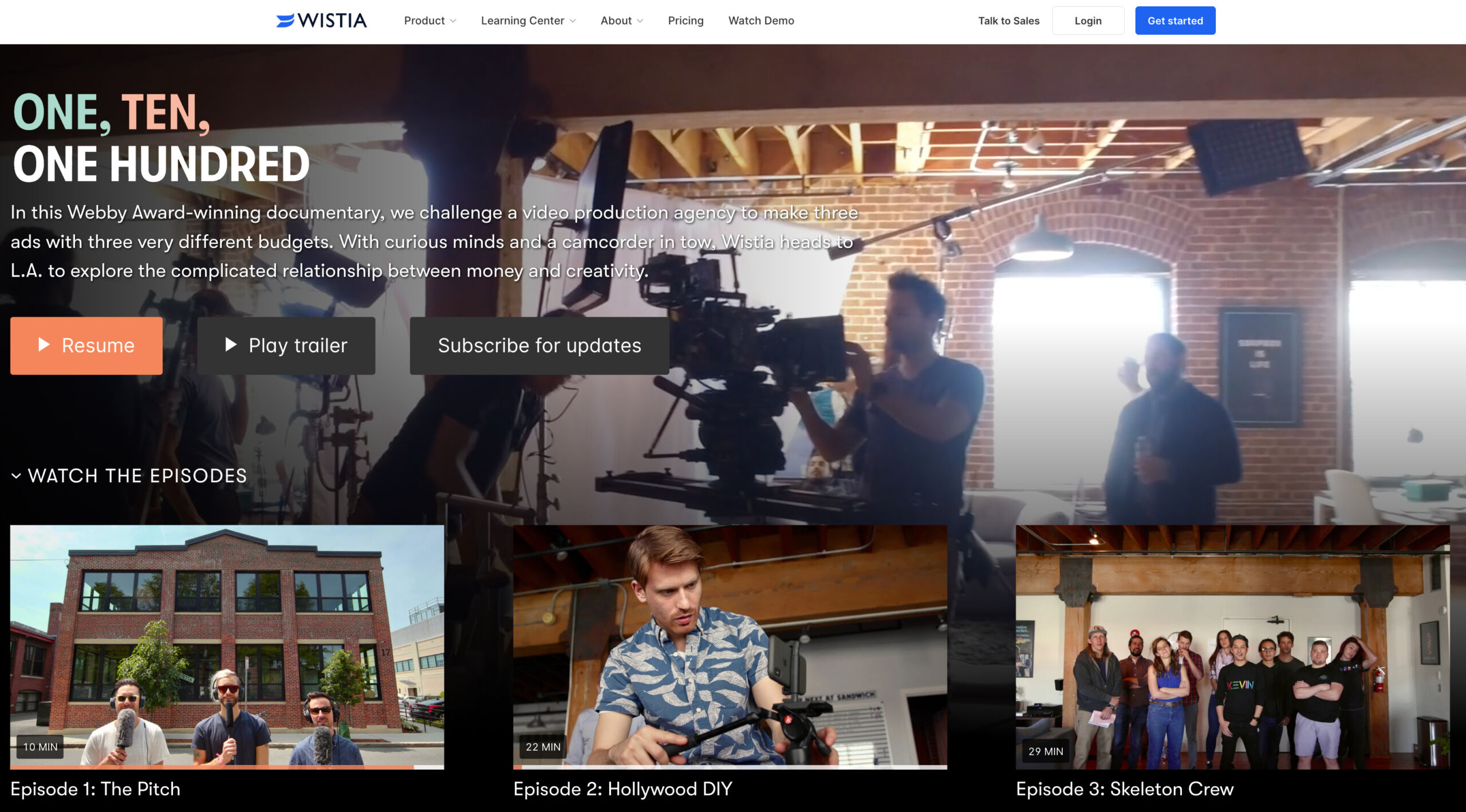

One of the projects was One, Ten, One Hundred, a Webby award-winning series where they challenged a video production agency to make three ads for Wistia: one with a $1,000 budget, one with $10,000, and one with $100,000. The project’s thesis was to explore the relationship between money and creativity.

“We made a feature-length documentary that was green-lit at that exact moment once we were profitable,” Savage says. “[We said], ‘It’s not going to give us a return next month, but we don’t think anyone else is going to do it. So it’ll probably stand out. It’ll probably work.’ And it worked unbelievably well.”

The trailer launch of One, Ten, One Hundred got millions of views, so they knew the idea had momentum. Instead of uploading the series on YouTube, they decided to host it on the Wistia site.

“That was not going to get as much natural distribution,” Savage says. “But it will mean if you came and you watched this whole thing, you’re going to ask, ‘What else do they do?’”

The series generated tens of thousands of views on their site, leading to hundreds of new customers. In the first month and a half of the doc’s launch, Wistia had more time spent on their channels than from all their marketing in the previous year.

“This is what we wanted to watch,” Schwartz says. “It’s content that didn’t exist, and we would be really psyched to watch the entire thing.”

Schwartz says audiences are savvy and know when brands are just trying to push a call to action or a sale. He says content marketing activities, like One, Ten, One Hundred, must be entertaining and provide value to an audience.

“You do that consistently over time, and that’s how you build a following and an engine,” Schwartz says.

The post These Founders Bought Back Their Business: Chris Savage and Brendan Schwartz of Wistia appeared first on Foundr.