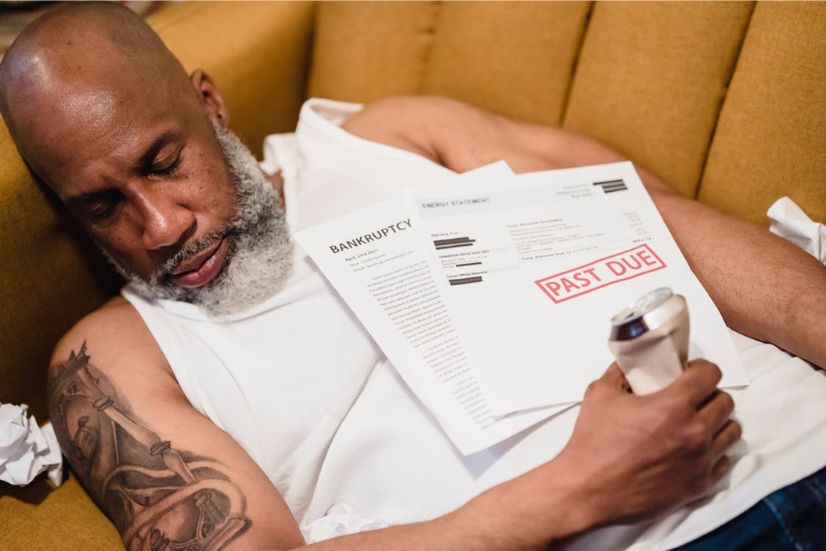

Running a business isn’t easy. If you’ve owned a business at some point, you’ve probably experienced the roller coaster of highs and lows, from unanticipated success to unexpected pitfalls. Sometimes, these lows can take the form of serious financial setbacks, even in bankruptcy–the dreaded result when debt becomes too much for you to recuperate.

Fortunately, it doesn’t have to end with bankruptcy. Here are seven ways to avoid bankruptcy and protect your business.

Take Out Installment Loans

Installment loans can be a great way to finance your business without the risk of bankruptcy. These installment loans provide more flexibility with repayment terms, allowing you to pay off the loan over time instead of all at once. The interest rates may also be lower than other types of financing, giving you more breathing room when it comes to repayment.

For example, CreditNinja’s installment loan options can help you buy equipment, fund marketing campaigns, and what you need to mount a possible comeback without the risk of bankruptcy. And while they’re not without risk, they can be a great tool to finance your business needs responsibly.

Know Your Financial Situation

Keeping track of your finances is essential to avoiding bankruptcy. Ensure you know how much money you have coming in and where it’s going out. Create budget forecasts that are realistic and easy to maintain over time, and review them regularly to ensure you won’t be caught off-guard.

In addition, consider your debt-service costs, such as loan payments, interest rates, and other debts you may have to pay off. Knowing your financial situation upfront can help you make better decisions regarding spending and income strategies.

Prioritize Payments

One of the most critical steps to prevent bankruptcy is prioritizing your payments. Ensure you pay off high-interest debt first and work your way down. It’s also important to pay off your loans on time. Missing payments could lead to dangerous debt levels and put you at risk of bankruptcy.

In the long term, having a plan to pay off high-interest debt first can help you save money and keep your company from going bankrupt. And if you find yourself unable to make payments on time, get in touch with your creditors and negotiate a payment plan that works for both parties.

Hire Professional Help

It may be beneficial to seek help from a professional if you are overwhelmed with debt and unable to make payments on time. A financial advisor or bankruptcy attorney can review your situation and provide a practical solution for repayment that fits your budget. They can also advise you on filing for bankruptcy if it becomes necessary.

Additionally, consider taking a class or two on personal finance. It can help you gain valuable insight into your financial situation and provide additional strategies for avoiding bankruptcy.

Analyze Your Spending

Take the time to analyze your spending habits to determine if there are areas where you could cut back or save more money. Some common ways to reduce expenses include buying in bulk, DIYing where possible, and switching to cheaper service providers or suppliers.

You may also reduce hours or postpone costly projects until the funds are available. These small changes can add up significantly, helping maintain your business financially stable.

Create Emergency Funds

It’s always a good idea to set up an emergency fund in case of unexpected expenses. Make sure you are setting aside some of your monthly profits into this fund so that if any unexpected costs arise, you can cover them without taking out additional loans or going into debt. It will help you maintain financial stability and reduce the risk of bankruptcy.

Furthermore, consider setting up an emergency savings account with a separate bank or credit union. That way, you can just transfer funds from the account without worrying about penalties or fees.

Educate Yourself

Taking the time to educate yourself on personal finance and financial management can also help you avoid bankruptcy. Read books, attend seminars or webinars, and even take courses on the subject. Knowing the basics of financial planning will give you a better understanding of ensuring your business remains financially sound during tough times.

Finally, make sure you are staying up-to-date on changes in bankruptcy laws. These laws are constantly evolving, and it’s essential to know any updates that could impact your business. And, if you ever find yourself in a situation where bankruptcy is becoming a possibility, having the proper knowledge and information can help make the process smoother.

Final Thoughts

Bankruptcy can be a difficult and stressful situation for any business, but by taking the proper steps, you can avoid it and ensure the financial success of your business. Taking out installment loans, creating an emergency fund, analyzing spending habits, and educating yourself on personal finance are all great ways to stay financially stable. With these measures in place, you can maintain your financial health and reduce the risk of bankruptcy.

Additionals:

The post How To Avoid Bankruptcy And Protect Your Business From Going Under appeared first on Social Media Magazine.